As the cost of living crisis continues, Isle of Wight Council is to launch a consultation to consider variations to the Local Council Tax Support Scheme.

Nearly 10,000 Islanders receive council tax support this way, including those in work but below a threshold that is dependent on personal circumstances.

Currently assistance starts at 20%, rising up in several steps to 70% maximum assistance, depending on the household and financial circumstances,

The proposal for the scheme commencing in April 2024 is to keep the scheme as it is, however it is also seeking views on varying the maximum level of support by 5% either way.

Officials say both alternatives have a significant impact on the council budget. Higher levels of relief would require savings and cuts elsewhere. Lower levels of relief could lead to an increase in council tax arrears and lower levels of Council Tax collection.

The implications of changes to the scheme will not affect pension-age recipients of local council tax support, but could affect both working-age recipients as well as users of council services more widely and therefore will be open to all residents to participate.

The results of the consultation form part of the decision-making process for setting council tax and the overall council budget next year.

The consultation is available on the Local council tax support scheme consultation page and the closing date is October 2. Copies can be obtained from council offices and libraries from this week.

Councillor Coy On Isle Of Wight Social Housing

Councillor Coy On Isle Of Wight Social Housing

Warning For Islanders Selling Vehicles To Be 'Scam Aware'

Warning For Islanders Selling Vehicles To Be 'Scam Aware'

Bus Fares Set To Rise Following Council Meeting

Bus Fares Set To Rise Following Council Meeting

Small Business Support Proposal Passed By Isle Of Wight Council

Small Business Support Proposal Passed By Isle Of Wight Council

Five-Year Isle Of Wight Area Of Outstanding Natural Beauty Plan Unanimously Approved

Five-Year Isle Of Wight Area Of Outstanding Natural Beauty Plan Unanimously Approved

More Islanders Cross The Solent With Wightlink’s Discounted Fares For NHS Appointments

More Islanders Cross The Solent With Wightlink’s Discounted Fares For NHS Appointments

Hampshire And Isle Of Wight Air Ambulance Funds Defibrillators For The Community

Hampshire And Isle Of Wight Air Ambulance Funds Defibrillators For The Community

Isle Of Wight Council Budget Pressures Likely To Continue Following Autumn Statement

Isle Of Wight Council Budget Pressures Likely To Continue Following Autumn Statement

Council Approves Support Package To Help Islanders On Low Incomes

Council Approves Support Package To Help Islanders On Low Incomes

Isle Of Wight Councillor In Mental Health Priority Motion

Isle Of Wight Councillor In Mental Health Priority Motion

Bird Keepers Urged To Remain Vigilant Following Increased Avian Influenza Risk

Bird Keepers Urged To Remain Vigilant Following Increased Avian Influenza Risk

Island Pupils Receive Lesson In Road Safety That Could Save Lives

Island Pupils Receive Lesson In Road Safety That Could Save Lives

New Shanklin Flats Given Green Light

New Shanklin Flats Given Green Light

Joe Robertson Appointed Parliamentary Private Secretary For Shadow Culture, Media And Sport

Joe Robertson Appointed Parliamentary Private Secretary For Shadow Culture, Media And Sport

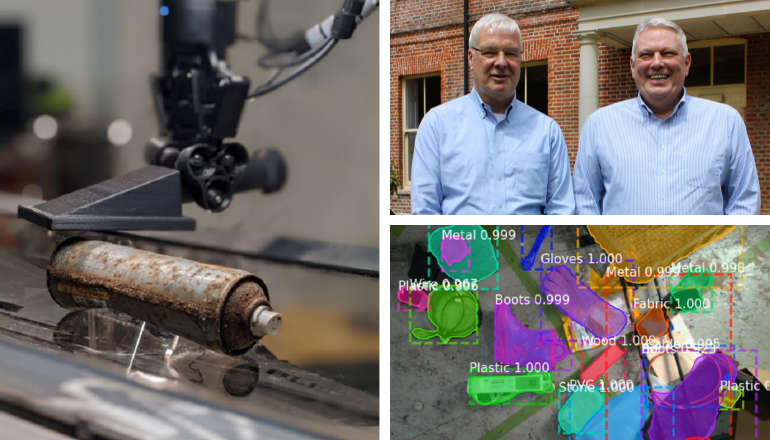

Shanklin Company Making Nuclear Waste Sorting Safer, Greener And Cheaper

Shanklin Company Making Nuclear Waste Sorting Safer, Greener And Cheaper

Five-Year Isle Of Wight Landscape Plan Decision On Horizon

Five-Year Isle Of Wight Landscape Plan Decision On Horizon

Help Sought For Isle Of Wight's Struggling Small Businesses

Help Sought For Isle Of Wight's Struggling Small Businesses

Primary School Admissions For September 2025 Now Open

Primary School Admissions For September 2025 Now Open

Island Families Invited To Take Tour Of St Mary's Special Care Baby Unit

Island Families Invited To Take Tour Of St Mary's Special Care Baby Unit

Work To Sink Three Boreholes At Leeson Road Due To Finish This Week

Work To Sink Three Boreholes At Leeson Road Due To Finish This Week