Second homeowners and empty property owners could be made to pay double their council tax on the Isle of Wight, if new legislation is approved.

As the housing crisis continues and with more than 3,000-second homes now recorded on the Island, the Isle of Wight Council is looking to introduce new tax premiums.

They could be introduced nationally for local authorities through the Levelling Up and Regeneration Bill which is currently in its fourth stage in the House of Commons.

Once it is approved, the IW Council is looking to enforce the extra charges from April 1, 2024.

An Alliance administration spokesman reiterated the need for national legislation to be introduced and said they were only looking into the possibility in principle like other local authorities have done.

They said it would be inappropriate not to look at this option as it is a potential source of income generation.

In North Yorkshire, councillors have backed plans to introduce the council tax premiums should government allow it.

They have said the proposals would help bring more houses back into use for local people after they had been priced out of the housing market but also provide a £14 million boost to the council’s finances.

In current IW Council tax policies, any property unoccupied and unfurnished for two years is charged an extra 100 per cent of their council tax.

For properties empty for at least five years, the charge goes up to an extra 200 per cent and those empty for ten years are hit with 300 per cent extra.

In figures included in the council’s Draft Island Planning Strategy, there are thought to be 1,150 empty homes on the Island although a more ‘meaningful figure’ would be 746.

The council says that is because the lower figure does not include homes empty for probate reasons, residents receiving care elsewhere or repossessions.

The council is now looking to bring in a 100 per cent charge for properties that have been left empty and unfurnished for a year as well as charging an extra 100 per cent for second homes.

Isle of Wight councillors will be asked to support the move in January.

Councillor Coy On Isle Of Wight Social Housing

Councillor Coy On Isle Of Wight Social Housing

Warning For Islanders Selling Vehicles To Be 'Scam Aware'

Warning For Islanders Selling Vehicles To Be 'Scam Aware'

Bus Fares Set To Rise Following Council Meeting

Bus Fares Set To Rise Following Council Meeting

Small Business Support Proposal Passed By Isle Of Wight Council

Small Business Support Proposal Passed By Isle Of Wight Council

Five-Year Isle Of Wight Area Of Outstanding Natural Beauty Plan Unanimously Approved

Five-Year Isle Of Wight Area Of Outstanding Natural Beauty Plan Unanimously Approved

More Islanders Cross The Solent With Wightlink’s Discounted Fares For NHS Appointments

More Islanders Cross The Solent With Wightlink’s Discounted Fares For NHS Appointments

Hampshire And Isle Of Wight Air Ambulance Funds Defibrillators For The Community

Hampshire And Isle Of Wight Air Ambulance Funds Defibrillators For The Community

Isle Of Wight Council Budget Pressures Likely To Continue Following Autumn Statement

Isle Of Wight Council Budget Pressures Likely To Continue Following Autumn Statement

Council Approves Support Package To Help Islanders On Low Incomes

Council Approves Support Package To Help Islanders On Low Incomes

Isle Of Wight Councillor In Mental Health Priority Motion

Isle Of Wight Councillor In Mental Health Priority Motion

Bird Keepers Urged To Remain Vigilant Following Increased Avian Influenza Risk

Bird Keepers Urged To Remain Vigilant Following Increased Avian Influenza Risk

Island Pupils Receive Lesson In Road Safety That Could Save Lives

Island Pupils Receive Lesson In Road Safety That Could Save Lives

New Shanklin Flats Given Green Light

New Shanklin Flats Given Green Light

Joe Robertson Appointed Parliamentary Private Secretary For Shadow Culture, Media And Sport

Joe Robertson Appointed Parliamentary Private Secretary For Shadow Culture, Media And Sport

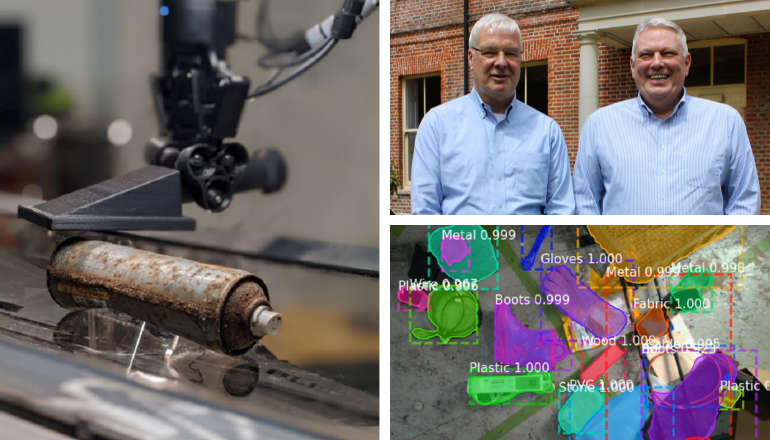

Shanklin Company Making Nuclear Waste Sorting Safer, Greener And Cheaper

Shanklin Company Making Nuclear Waste Sorting Safer, Greener And Cheaper

Five-Year Isle Of Wight Landscape Plan Decision On Horizon

Five-Year Isle Of Wight Landscape Plan Decision On Horizon

Help Sought For Isle Of Wight's Struggling Small Businesses

Help Sought For Isle Of Wight's Struggling Small Businesses

Primary School Admissions For September 2025 Now Open

Primary School Admissions For September 2025 Now Open

Island Families Invited To Take Tour Of St Mary's Special Care Baby Unit

Island Families Invited To Take Tour Of St Mary's Special Care Baby Unit

Work To Sink Three Boreholes At Leeson Road Due To Finish This Week

Work To Sink Three Boreholes At Leeson Road Due To Finish This Week