A five per cent council tax rise has been agreed by the Isle of Wight Council.

It means an average household on the Island, paying Band D rates of council tax, will fork out £86.46 more a year — taking the total to £1,817.61.

The Alliance’s budget was passed with no amendments.

Along with the tax hike, the ruling Alliance administration will impose that Island residents will face an increase in parking charges, Floating Bridge fees and the costs of burials and cremations.

In the areas of significant pressure to the authority, adult social care and children’s services, £7.6m and £4.3m respectively, have been put forward in additional spending.

Two per cent of tax will go straight towards adult social care and help bridge the gap of funding pressures although it has not stopped some services being cut.

Stroke social care support, a patient falls coordinator with the NHS Trust and cross-Solent patient transport funding have all been on the chopping block.

Cabinet member for strategic finance and transformational change, Cllr Chris Jarman, said it was a survival budget for the authority, with significant cuts in many areas, having faced the turmoil in the world and the Island’s economics.

He said it is a budget that none of the councillors would have wished for and one that has elements which could feel unsatisfactory to all.

Cllr Jarman was against both of the alternative budgets put forward by the Liberal Democrat group and Cllr Geoff Brodie, as he said they would increase the financial instability of the council.

Both proposed amendments, which looked to cut the IT budget, posed operational risks, councillors said, as it would lower the council’s defences to cyber attacks in coming years.

The amendments were both voted on but fell, with more votes against than in favour.

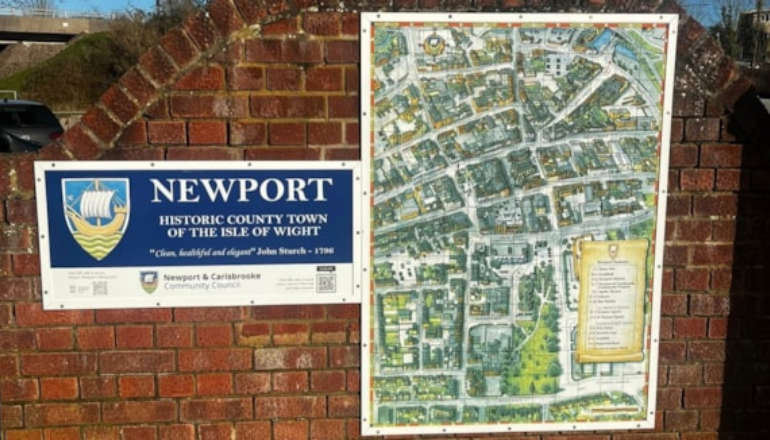

Heritage Action Zone Funding Sees New Town Maps Installed Around Newport

Heritage Action Zone Funding Sees New Town Maps Installed Around Newport

Isle Of Wight Schools Unite For Mufti Day To Support Local Teen Arlo

Isle Of Wight Schools Unite For Mufti Day To Support Local Teen Arlo

Round The Island Race Entries Open

Round The Island Race Entries Open

Investigation Underway After Sandown Pharmacy Break-In

Investigation Underway After Sandown Pharmacy Break-In

Island Views Sought On New Water Recycling Project

Island Views Sought On New Water Recycling Project

RNLI Urges Public To Stay Safe As Storm Éowyn Hits UK

RNLI Urges Public To Stay Safe As Storm Éowyn Hits UK

Borrow A Thermal Camera To Find Cold Spots In Your Home

Borrow A Thermal Camera To Find Cold Spots In Your Home

Newport Sainsbury's Café Set To Close As Part Of Supermarket Cuts

Newport Sainsbury's Café Set To Close As Part Of Supermarket Cuts

Three Men Charged In Connection With Sandown Hotel Burglary

Three Men Charged In Connection With Sandown Hotel Burglary

Four Arrested And Two In Hospital Following Newport Burglary

Four Arrested And Two In Hospital Following Newport Burglary

Hovertravel Set To Reduce Services Due To Financial Pressures

Hovertravel Set To Reduce Services Due To Financial Pressures

Islanders Invited To Share Experience Of Cancer Treatment

Islanders Invited To Share Experience Of Cancer Treatment

Powder Monkey Group Acquires Goddards Brewery

Powder Monkey Group Acquires Goddards Brewery

Primary School Locked Down After Man Enters In Need Of Medical Assistance

Primary School Locked Down After Man Enters In Need Of Medical Assistance

Criminals Dealt Crushing Blow As Seized E-Scooters And Electric Motorcycles Destroyed

Criminals Dealt Crushing Blow As Seized E-Scooters And Electric Motorcycles Destroyed

Isle Of Wight Weather Warnings Issued With Storm Éowyn Forecast To Bring 80mph Winds

Isle Of Wight Weather Warnings Issued With Storm Éowyn Forecast To Bring 80mph Winds

Friends Of St Mary’s Hospital Donate £27,000 To Support Patients And Staff

Friends Of St Mary’s Hospital Donate £27,000 To Support Patients And Staff

Wightlink Invests In Its Portsmouth Car Ferry Port

Wightlink Invests In Its Portsmouth Car Ferry Port

Isle Of Wight Charity Leader Honoured With BBC One Show Recognition

Isle Of Wight Charity Leader Honoured With BBC One Show Recognition