An Island-wide tax hike could be on the cards as the Isle of Wight Council’s budget looms ever closer.

If the ruling Alliance administration’s budget is approved tonight (Wednesday), the average taxpayer, in a Band D property, could be paying nearly £90 more a year for the council’s services.

At arguably the council’s most important meeting of the year, the authority’s future finances, price increases and service cuts will be decided.

The budget has been hailed by the Alliance group as one of the toughest ever, as it has had to contend with inflation, rising energy costs and what it calls a lack of government funding.

To help fill the council’s coffers, all local authorities, including the Isle of Wight’s, have been given permission by national government to raise the council tax for residents by five per cent — with two per cent going directly to adult social care.

The Alliance’s budget proposals could see:

- a rise in parking charges and bereavement service fees

- voluntary redundancies

- a cultural venue development in Ryde in partnership with the Shademakers

- parks and cemeteries not being maintained as regularly

- highways safety works on the A3056

- Floating Bridge prices rise back to pre-covid levels

- coastal protection scheme

- a cut to cross-Solent patient transport

- resurfacing of Queensgate’s multi-use games area (MUGA)

- more electric vehicle charging points

Who has proposed alternative budgets?

Two alternative budgets have been produced so far — from the Liberal Democrat group and by Cllr Geoff Brodie.

Both are proposing cuts to the IT budget, reducing the number of laptops and phones replaced in 2026/17, but keeping the level of council tax increase at five per cent.

In the Liberal Democrat proposals, the money cut would go towards funding capital for the council’s housing company to speed up the production of affordable housing on the Island.

In Cllr Brodie’s proposals, the money would be used to reinstate proposed cuts from the Alliance in adult social care — keeping the falls prevention co-ordinator at the Isle of Wight NHS Trust and the social care stroke support contract.

How much could your Isle of Wight Council Tax go up by?

- Band A – £57.64 – up to £1,211.74

- Band B – £67.25 – up to £1,413.70

- Band C – £76.85 – up to £1,615.65

- Band D – £86.46 – up to £1,817.61

- Band E – £105.67 – up to £2,221.52

- Band F – £124.89 – up to £2,625.44

- Band G – £144.10 – up to £3,029.35

- Band H – £172.92 – up to £3,635.22

The increase in council tax is also on top of rises in the fire and police precepts, as well as some town and parish councils on the Island.

The meeting starts at 5pm and is allowed to last for four hours.

You can view the agenda, associated papers and watch the meeting via the council’s website here:

https://iow.moderngov.co.uk/ieListDocuments.aspx?CId=172&MId=1438.

Think Pharmacy First This Half Term Says Island's NHS

Think Pharmacy First This Half Term Says Island's NHS

Isle of Wight Council Supporting Delivery Of Newport Affordable Housing Scheme

Isle of Wight Council Supporting Delivery Of Newport Affordable Housing Scheme

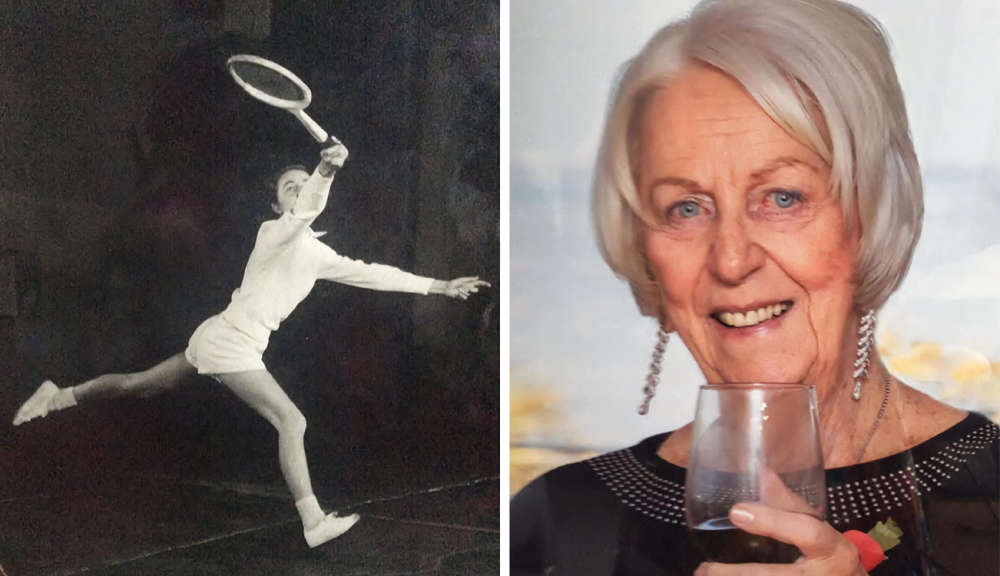

Ryde's Pat Awarded Freedom Of The Town For Sport Contributions

Ryde's Pat Awarded Freedom Of The Town For Sport Contributions

Could You Restart A Heart? Islanders Urged To Seek CPR Training

Could You Restart A Heart? Islanders Urged To Seek CPR Training

Upgrades Planned For Major Island Caravan Site

Upgrades Planned For Major Island Caravan Site

Planners Approve Alverstone Bungalow Despite Objections From Residents

Planners Approve Alverstone Bungalow Despite Objections From Residents

New Vote Of Confidence For Island Services In Healthwatch Report

New Vote Of Confidence For Island Services In Healthwatch Report

Finance Reserve Row Breaks Out Between County Hall Groups

Finance Reserve Row Breaks Out Between County Hall Groups

Go Ahead Granted For New Ten Surgery Dental Practice In Ryde

Go Ahead Granted For New Ten Surgery Dental Practice In Ryde

Drugs Arrests Made After Officers Raid Home Near Newport

Drugs Arrests Made After Officers Raid Home Near Newport

Call 111 First - Islanders Urged To Use The Correct Services This Half Term

Call 111 First - Islanders Urged To Use The Correct Services This Half Term

Children And Families Safeguarding Now Under Isle of Wight Council Control

Children And Families Safeguarding Now Under Isle of Wight Council Control

Ryde Sea Cadets Get Taste Of Life At Sea Thanks To Wightlink

Ryde Sea Cadets Get Taste Of Life At Sea Thanks To Wightlink

Hovertravel Makes The Cut For 'Leaders' Status In UK Inclusive Transport

Hovertravel Makes The Cut For 'Leaders' Status In UK Inclusive Transport

Isle of Wight NHS Trust Celebrates Apprentices As More Than 500 Supported

Isle of Wight NHS Trust Celebrates Apprentices As More Than 500 Supported

Bomb Squad Respond To Suspected Ordnance On Island Farmland

Bomb Squad Respond To Suspected Ordnance On Island Farmland

Info On Careers And Apprenticeships Available At Island Futures Job Fair

Info On Careers And Apprenticeships Available At Island Futures Job Fair

New HoverBlue Discounts Available For Island Residents

New HoverBlue Discounts Available For Island Residents

Older Island Residents Invited To Have Free RSV Vaccine

Older Island Residents Invited To Have Free RSV Vaccine

Lord Louis Children's Library Reopens With Range Of Activities On Offer

Lord Louis Children's Library Reopens With Range Of Activities On Offer