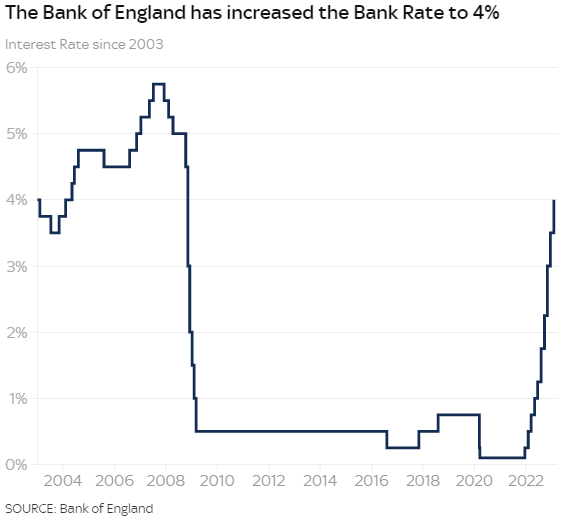

The Bank of England has raised UK interest rates by a further half percentage point to 4%, but given its clearest signal yet that borrowing costs may now be nearing their peak.

It's now expected the UK will enter a 'milder than expected' recession later this year, according to the Bank of England.

This was the Bank's tenth successive interest rate increase, but in the accompanying documentation, it hinted that there is a chance it might be the last for the time being, saying that it would only raise rates further "if there were to be evidence of more persistent [inflationary] pressures" than in its forecasts.

Those forecasts suggest that inflation has now peaked, and that it will come down gradually this year and next, eventually dropping beneath the Bank's 2% target.

The Bank also upgraded its forecast for the economy.

While it still projects a technical recession this year, it would be a very shallow recession, with overall growth falling by 0.5% in 2023, compared with its November forecast of a 1.5% fall.

(c) Sky News

Seven members of the nine-person Monetary Policy Committee supported the half percentage point increase, but two members - Swati Dhingra and Silvana Tenreyro - voted to leave borrowing costs on hold.

All told, while the increase today is significant, the hints included in the Bank's minutes represent a marked change in tone.

Previously it had said that it was ready to respond "forcefully" to higher inflation; this time, that language was removed.

Previously it had said further rate increases might be required if the economy behaved in line with their forecasts; this time it indicated that rate increases were dependent on higher inflation than in its forecasts.

The shifts in language leave the door open for some small further increases in borrowing costs but provide the firmest signal yet that UK interest rates are now at or close to their peak.

Still, while the outlook for the UK economy is better than in the Bank's previous forecasts, it is nonetheless far weaker than in recent years.

While the average UK growth rate pre-financial crisis was around 2.5% and around 1.5% post-pandemic, the Bank expects underlying growth of just 0.7% in the coming years.

Moreover, because of the fall in national income projected this year, it now expects that the size of the economy will still be at 2019 levels in 2026 - a full seven years of lost growth.

Many other countries around the world have already exceeded their post-pandemic level; the UK, according to the Bank's figures, is set to languish below it until the second half of this decade.

(c) Sky News 2023: Bank of England hikes interest rates by 0.5 percentage points in tenth consecutive rise

Yarmouth's Kings Head To Feature Bed And Breakfast Accommodation

Yarmouth's Kings Head To Feature Bed And Breakfast Accommodation

New Low Cost Flats Could Come To Ryde - If Plans Get Approved

New Low Cost Flats Could Come To Ryde - If Plans Get Approved

Casualty Airlifted To Hospital Following Serious Overnight Crash Near Porchfield

Casualty Airlifted To Hospital Following Serious Overnight Crash Near Porchfield

Engine Problems Lead To Yarmouth RNLI Callout To Osborne Bay

Engine Problems Lead To Yarmouth RNLI Callout To Osborne Bay

Ryde Academy Students Donate To Two Worthy Causes At Christmas

Ryde Academy Students Donate To Two Worthy Causes At Christmas

Road Improvement Works To Get Underway From The Very Start Of The New Year

Road Improvement Works To Get Underway From The Very Start Of The New Year

Isle of Wight Youth Trust Benefits From Big Give Support

Isle of Wight Youth Trust Benefits From Big Give Support

Council Chair 'Furious' Over Floating Bridge Replacement Fiasco

Council Chair 'Furious' Over Floating Bridge Replacement Fiasco

Fire Service Travel To Island Contributes To Huge Budget Overspend

Fire Service Travel To Island Contributes To Huge Budget Overspend

Department Approaching Completion In Ryde As Opening Date Announced

Department Approaching Completion In Ryde As Opening Date Announced

Guidance Issued Over Sharps Disposal As Waste Teams At Risk

Guidance Issued Over Sharps Disposal As Waste Teams At Risk

Police Warnings Over E-Scooters Ahead Of Christmas Day

Police Warnings Over E-Scooters Ahead Of Christmas Day

Controversial Freshwater Housing Proposal Turned Down

Controversial Freshwater Housing Proposal Turned Down

Rare Mantis Shrimp Discovery Made In Waters Off Isle Of Wight

Rare Mantis Shrimp Discovery Made In Waters Off Isle Of Wight

Man In 50s Confirmed Dead Following Newport Crash

Man In 50s Confirmed Dead Following Newport Crash

Pedestrian In Hospital With Serious Injuries Following Early Morning Motorcycle Crash

Pedestrian In Hospital With Serious Injuries Following Early Morning Motorcycle Crash

Cowes Stately Home To Have Facilities Upgraded As Part Of Approved Renovation

Cowes Stately Home To Have Facilities Upgraded As Part Of Approved Renovation

Ofsted Deliver Glowing Report For 'Welcoming' And 'Highly Ambitious' Island Primary School

Ofsted Deliver Glowing Report For 'Welcoming' And 'Highly Ambitious' Island Primary School

Help Available For Islanders To Cut Energy Bills

Help Available For Islanders To Cut Energy Bills

Cowes Lifeboat Performs Mid-Solent Rescue Of Fishing Boat

Cowes Lifeboat Performs Mid-Solent Rescue Of Fishing Boat