The trend of shop prices falling may be reversing as businesses face higher costs, according to industry data.

The pace of price drops slowed this month, according to figures from the British Retail Consortium (BRC).

November was the first time in 17 months that the inflation rate was higher than a month earlier.

While shop prices dropped 0.8% in October compared to a year earlier, the fall slowed 0.6% in November, according to BRC figures.

Money blog: Most common scam of 2024 revealed ahead of Black Friday

The figures may signal the end of falling inflation given cost pressures being placed on big businesses, according to BRC chief executive Helen Dickinson.

Retailers face a barrage of costs which the BRC forecasts will amount to an extra £7bn for retail businesses next year.

Budget measures such as the increase in employers' national insurance contributions and a higher minimum wage form part of those costs as does the forthcoming packaging tax to fund recycling efforts.

These extra costs will just push up consumer prices, Ms Dickinson said.

"Retail already operates on slim margins, so these new costs will inevitably lead to higher prices."

The official measure of inflation is already on the up with the first rise in three months recorded in October as energy bills rose. The rate of price rises rose sharply to 2.3% from 1.7% recorded a month earlier as the energy price cap was hiked.

If the government wants to prevent higher shop prices it must reconsider the April 2025 timeline for the new packaging levy and reduce the commercial property tax known as business rates "as early as possible", Ms Dickinson added.

Read more

Chancellor Rachel Reeves promises she will not raise taxes again

The minimum wage uplift will bring pay for people over 21 to £12.21 an hour and take effect in April. People aged 18 to 20 will have to earn at least £10 an hour - something the TUC (Trades Union Congress) said could benefit 420,000 young people - as part of the government's goal of paying the same minimum wage to all workers, regardless of age.

Also from April, employers will have to pay more national insurance for their staff.

Businesses' national insurance contributions will increase from 13.8% to 15% with the current £9,100 threshold at which employers start to pay the tax on employees' earnings lowering to £5,000.

Chancellor Rachel Reeves has defended the increase saying half of all businesses - roughly a million firms - are paying either less or the same national insurance contributions as they were before the budget due to the uprated employment allowance, a tax credit for some employers.

(c) Sky News 2024: First rise in rate of shop inflation in 17 months - British Retail Consortium

COP29 strikes last ditch deal on funding for climate measures in vulnerable countries

COP29 strikes last ditch deal on funding for climate measures in vulnerable countries

'I'm looking to my own conscience': Three MPs on what they think of assisted dying bill

'I'm looking to my own conscience': Three MPs on what they think of assisted dying bill

Extra NHS capacity and Jobcentre reforms at heart of Labour's plan to 'get Britain working'

Extra NHS capacity and Jobcentre reforms at heart of Labour's plan to 'get Britain working'

Egypt: Two Britons believed to be among 16 missing as tourist boat sinks after being 'hit by large wave'

Egypt: Two Britons believed to be among 16 missing as tourist boat sinks after being 'hit by large wave'

Chancellor Rachel Reeves promises she will not raise taxes again

Chancellor Rachel Reeves promises she will not raise taxes again

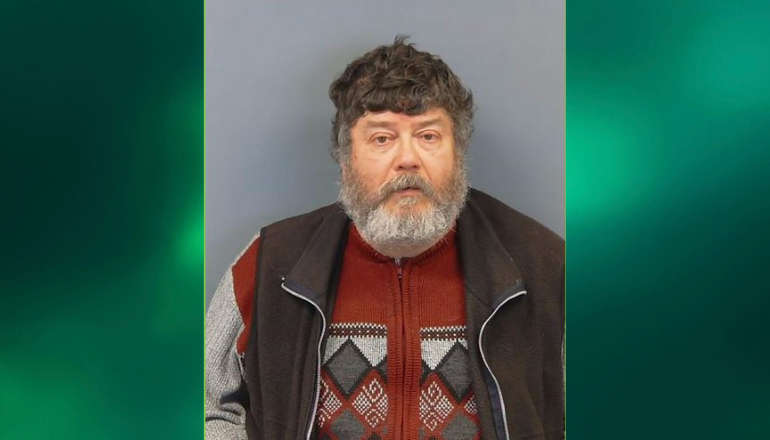

Former Isle Of Wight Assistant Church Organist Jailed For Sexually Abusing Child In 1990s

Former Isle Of Wight Assistant Church Organist Jailed For Sexually Abusing Child In 1990s

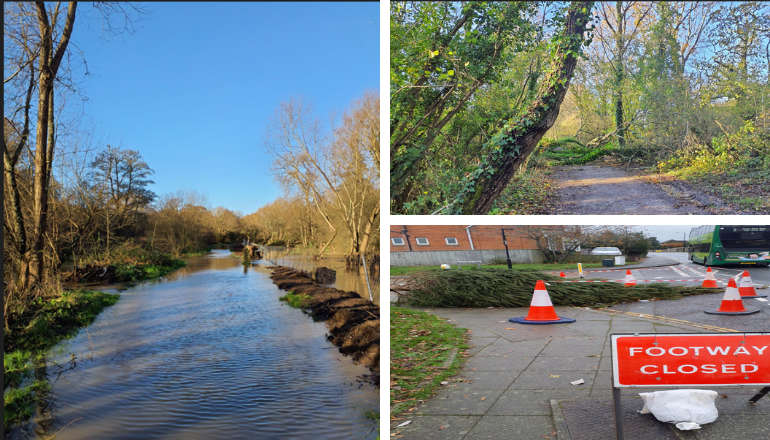

Bert Fallout Revealed By Island Roads

Bert Fallout Revealed By Island Roads

Ryde Wall Demolition Permission Granted

Ryde Wall Demolition Permission Granted

Seaview Garage To Become Artist Studio

Seaview Garage To Become Artist Studio