Five years ago, BP's chief executive did something very unusual for the boss of an oil and gas company - he pledged to produce less oil and gas.

Standing in front of the slogan "reimagine", scrawled freehand and lowercase in a shade of green, Bernard Looney, the lean and charismatic then-leader of the British-based oil giant, announced that BP "would become a very different kind of energy company".

His pitch was striking and very much of the moment.

A multinational that began as the Anglo-Persian Oil Company in 1909 would move away from its core products, cutting annual oil production, investing in renewable energy, and even suggested leaving some of its assets in the ground, unexploited.

Money blog: How much do you need to earn to be wealthy?

The aim, Mr Looney said, was to make BP net-zero by 2050, and to help the world do the same, an aspiration environmental campaigners never dared to imagine they would hear from a fossil fuel giant.

For all the styling, this was not an altruistic move from Mr Looney and the BP board.

With global leaders signed up to cutting carbon emissions and consumers increasingly enthusiastic about the alternatives, they saw money in the pivot to alternative sources.

COVID, only just beginning its circumnavigation of the globe when Mr Looney got to his feet in February 2020, may have reinforced faith in his bet, as skies went quiet and commuters stayed at home.

One fundamental question remained unanswered: Could BP continue to fund the dividends and return to shareholders by which markets, not activists, judge oil majors, and on which many investors depend for retirement funds to thrive?

Five years on the answer is no, and the climate has changed, in every sense.

Mr Looney is gone, dismissed for being a little too charismatic in undisclosed relationships with employees, and his successor, Canadian Murray Auchincloss, has seen the wind turn against his company and its chosen course.

COVID was followed by the Russian invasion of Ukraine and a spike in energy prices that delivered a windfall to oil and gas majors and their shareholders.

BP delivered a profit of $13.8bn but comparison with its competitors, notably Shell, is unflattering.

Read more:

Who's given Ukraine most aid - and does it have enough rare earth metals to 'pay back' US?

Its share price has lagged as oil and gas have proved both cheaper and more profitable than wind and solar in an inflationary environment.

Its debts meanwhile have grown, swollen by borrowing to fund major investments in renewables, while Shell's have been cut courtesy of post-Ukraine profits.

With investor sentiment turning, accelerated by activist fund Elliott, which has built a reported 5% stake, Mr Auchincloss has slammed on the brakes.

Under pressure after five quarters of unreliable revenue, profit and debt forecasts, he is taking British Petroleum back to petroleum.

Back to basics

The contrast with Mr Looney's strategic reset could not have been more marked. Speaking on a webcast with only a small in-person audience, the sober Mr Auchincloss stood next to a new slogan: "Growing shareholder value", in a mixed-case, formal typeface.

His analysis was equally clear: "In 2020 we made some bold strategic changes, accelerating into the energy transition while progressively reducing our hydrocarbon business.

"We then saw COVID, the war in Ukraine, a recession and the shift in attitudes of markets and governments have a fundamental impact on the energy system... Our optimism for a fast (energy) transition was misplaced, and we went too far, too fast."

His alternative can be summarised as back to basics. Oil production will increase, almost to 2019 levels, and capital investment will be focused on oil and gas, 75% of it on "upstream" extraction, and less than 5% spent on renewables.

Mr Auchincloss's case is that oil and gas will be in "robust" global demand until 2035, and his message to shareholders is he intends to exploit it for their benefit.

No consensus

Not all shareholders agree, with 48 UK investors demanding a vote on the reset, and the UK Sustainable Investment Finance Association denouncing it as a retrograde turn away from the energy of the future that could leave BP saddled with stranded assets.

Coming on the same day the UK government's Climate Change Committee (CCC) painted a picture of an inexorable transition to low-carbon energy, driven by electrification of home heating, cars and industry, it is an unsentimental bet on the carbon status quo, and on short-term returns.

By the 2040s, says the CCC, electric vehicles will be so ubiquitous that petrol stations will be hard to find.

Mr Auchincloss appears to be banking on BP forecourts being among them.

(c) Sky News 2025: Five years on from BP's ambitious pledge, the climate has changed in every sense

Sanctions against Russia have changed what Europe imports, but it's still worth billions to Putin

Sanctions against Russia have changed what Europe imports, but it's still worth billions to Putin

BP slashes renewables investment and boosts fossil fuel production

BP slashes renewables investment and boosts fossil fuel production

Trump shares AI video of Gaza vision featuring golden statues, bearded belly dancers and Netanyahu on a sunbed

Trump shares AI video of Gaza vision featuring golden statues, bearded belly dancers and Netanyahu on a sunbed

Post Office scandal: 21 ‘Capture’ cases now being investigated for miscarriages of justice

Post Office scandal: 21 ‘Capture’ cases now being investigated for miscarriages of justice

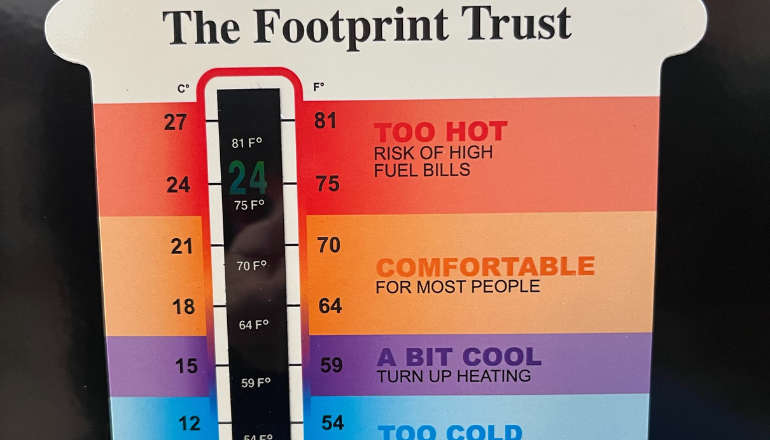

Energy bills for typical household to rise to £1,849 a year from April

Energy bills for typical household to rise to £1,849 a year from April

Wight Aid Helps Footprint Trust Boost Energy Savings

Wight Aid Helps Footprint Trust Boost Energy Savings

Isle Of Wight CAMRA Pub And Beer Of The Year 2024 Winners Announced

Isle Of Wight CAMRA Pub And Beer Of The Year 2024 Winners Announced

Have You Seen Missing Sarah Watson, 56, From Ventnor?

Have You Seen Missing Sarah Watson, 56, From Ventnor?

Newport Youth Hub 'Proving Very Effective' Says Council Leader

Newport Youth Hub 'Proving Very Effective' Says Council Leader